The Friday Focus: Issue 46

Welcome to our Friday newsletter. Here you find the most exciting crypto content from the previous week - curated for you by us.

If you haven’t already, hit the button below and subscribe to receive the newsletter in your inbox every Friday.

Weekly happenings

A big crypto week is coming to an end. The UN advised banning banks from holding crypto and asked developing countries to limit crypto adoption. The Philippines Central Bank will halt applications for new crypto firms for three years, and Uzbekistan blocks crypto exchanges from operating in the country. Struggling under a mountain of sanctions, the government of Iran takes the opposite route, making their first $10M import payment with self-mined crypto.

This week the US government banned its citizens from using the crypto mixing service Tornado Cash, and crypto exchanges are already blocking accounts that have received even small amounts from the mixing service. Still, enforcing these sanctions might prove very challenging, highlighted by an anonymous person who has been contaminating celebrities' ETH wallets by sending them small amounts through Tornado Cash.

Earnings season is here, giving us some insights into the operations of crypto companies. Unsurprisingly, the Q2 statements are not looking good. Coinbase racks up a $1.1B loss amid slumping crypto trading volumes, bitcoin miner Core Scientific suffers an $862M loss, and Galaxy Digital reports a $554M loss. These financial results don't scare BlackRock from diving into the crypto industry, launching a spot bitcoin private trust for institutional investors just one week after announcing a partnership with Coinbase.

Although the crypto capital raises have dramatically slowed this summer, we still see a few big ones now and then. The crypto analytics platform Messari plots a raise at a $300M valuation, and the blockchain project Injective raises $40M in a round led by Jump Crypto.

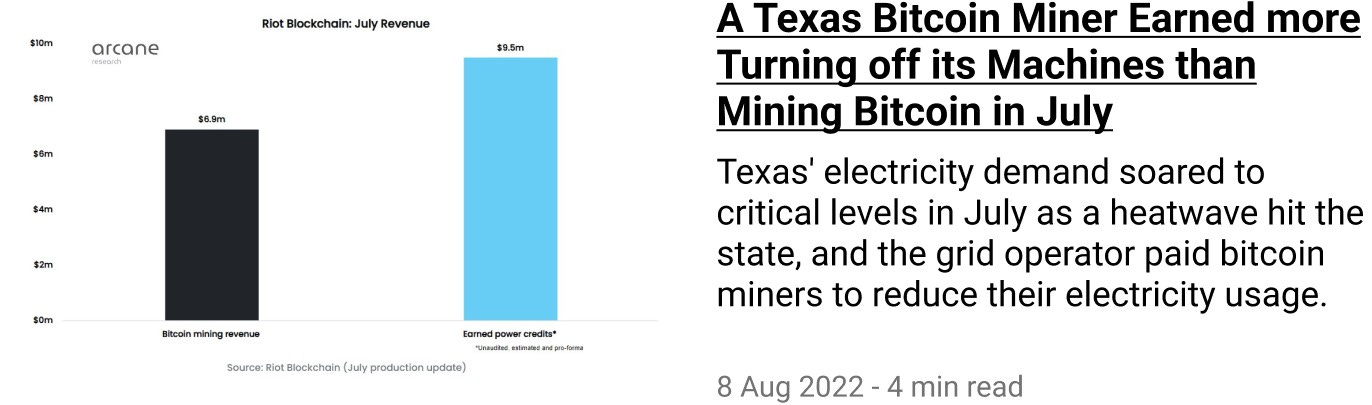

All eyes are fixed on Ethereum's upcoming merge. While most of the Ethereum community supports the merge, the miners' don’t like it as it will render them obsolete, and some of them are planning an Ethereum fork that will stay on proof-of-work. Three crypto exchanges are letting traders bet on tokens for the anticipated fork, and Binance is not ruling out listing the forked coin. Still, it will be tough for the miners to create a valuable ecosystem on the forked chain, as the two largest stablecoins - the glue of DeFi - has confirmed they will only support Ethereum's post-merge proof-of-stake chain.

Reading

Podcasts

Bitcoin Magazine Podcast: What the Sanctioning of Tornado Cash Means for Bitcoin

Stephan Livera Podcast: Bitcoin Security Long Term & ETH Centralisation

Unchained: Tornado Cash Sanctioned. Did the Government Overstep Its Bounds?

Arcane’s content

Want to sponsor this newsletter? Reach out to research@arcane.no